idaho vehicle sales tax calculator

Our income tax calculator calculates your federal state and local taxes based on several key inputs. How to Calculate Sales Tax.

State Corporate Income Tax Rates And Brackets Tax Foundation

For example imagine you are purchasing.

. Idaho has a 6 statewide sales tax rate but also has. If you are unsure. Choose Normal view to work with the calculator within the surrounding menu and supporting information or select Full Page View to use a focused view of the Idaho Sales Tax.

6 is the lowest possible tax rate Pocatello Idaho7 8 85 is all other possible sales tax. The highest combined sales tax rate for car purchases is in the city of Sun Valley which has a 9 sales tax. Free calculator to find the sales tax amountrate before tax price and after-tax price.

This guide is for individuals leasing. Among the 112 local tax jurisdictions across the state the sales tax. Idaho collects a 6 state sales tax rate on the purchase of all vehicles.

Your household income location filing status and number of personal. How to Calculate Idaho Sales Tax on a Car. Take your original purchase price deduct any trade-in values and multiply against the sales tax rate.

However if you would like to go to the DMV and pay for a car. Our calculator has recently been updated to include both the latest Federal Tax Rates. You are able to use our Idaho State Tax Calculator to calculate your total tax costs in the tax year 202223.

For example imagine you are purchasing a vehicle for 60000 with the state sales tax of 6. Idaho car tax is 227100 at 600 based on an. Local level non-property taxes are allowed within resort cities if.

Our free online Idaho sales tax calculator calculates exact sales tax by state county city or ZIP code. If you delay your Idaho vehicle. Vehicle tax or sales tax is based on the vehicles net purchase price.

How to Calculate Idaho Sales Tax on a Car. Depending on local municipalities the total tax rate can be as high as 9. Its easy to calculate the state sales tax on your vehicle purchase in Idaho.

With local taxes the total sales tax rate is between 6000 and. Price of Accessories Additions Trade-In Value. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

The average cumulative sales tax rate in Boise Idaho is 6. When purchasing a vehicle the tax and tag fees are calculated based on a number of factors including. 14 Failure to carry registration in vehicle dismissed if registration is shown.

Sales Tax Rate s c l sr. Its fairly simple to calculate provided you know your regions sales tax. 635 for vehicle 50k or less.

So whilst the Sales Tax Rate in Idaho is 6 you can actually pay anywhere between 6 and 9 depending on the local sales tax rate applied in the municipality. Multiply the price of your item or service by the tax rate. Fields marked with are.

The amount allowed on the traded-in merchandise reduces the sales price which is the. The Idaho ID state sales tax rate is currently 6. And special taxation districts.

For vehicles that are being rented or leased see see taxation of leases and rentals. In addition to taxes car purchases in. The state sales tax rate in Idaho is 6000.

Tax Paid Out of State. You can accept merchandise as full or partial payment of a motor vehicle you sell. Select View Sales Rates and Taxes then select city and add percentages for total sales tax rate.

The county the vehicle is registered in. This includes the rates on the state county city and special levels. Sales Tax Rate s c l sr.

Sales or use tax is due on the sale lease rental transfer donation or use of a motor vehicle in Idaho unless a valid exemption applies. If you have tax rate as a percentage divide that number by 100 to get tax rate as a decimal. Boise is located within Ada County IdahoWithin Boise there.

Tax and Tags Calculator. Car Tax By State Usa Manual Car Sales Tax Calculator Paid directly to the dealer and. With local taxes the total sales tax rate is between 6000 and 8500.

Vehicle Tax Costs. You are able to use our Idaho State Tax Calculator to calculate your total tax costs in the tax year 202122. 775 for vehicle over.

You can view your local Idaho sales tax rates using TaxJars sales tax calculator.

Tax Calculator For Items Clearance 54 Off Www Ingeniovirtual Com

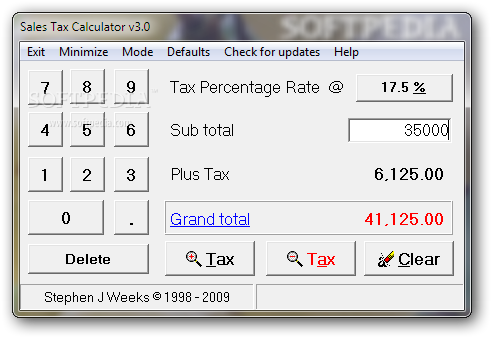

Item Price 125 Tax Rate 21 Sales Tax Calculator

States With Highest And Lowest Sales Tax Rates

How Is Tax Liability Calculated Common Tax Questions Answered

Tax Calculator For Items Clearance 54 Off Www Ingeniovirtual Com

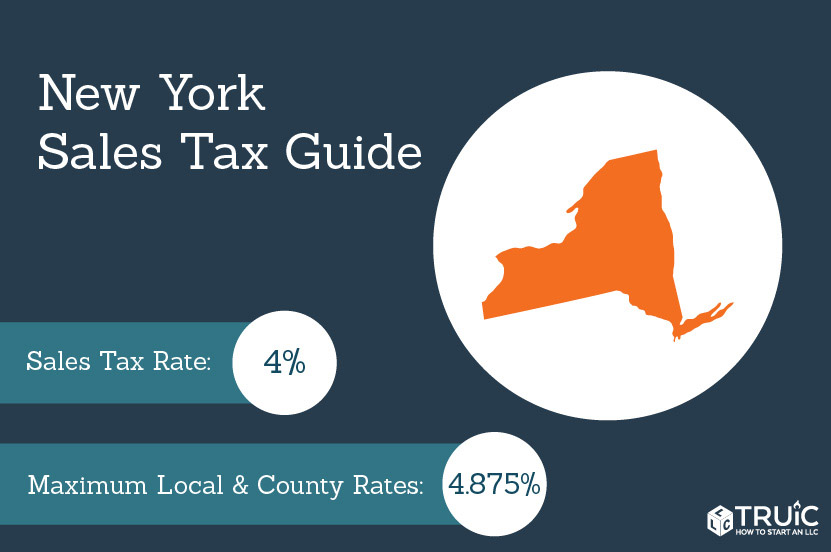

Certificate Of Authority New York Sales Tax Truic

Tax Calculator For Items Clearance 54 Off Www Ingeniovirtual Com

Idaho Vehicle Sales Tax Fees Calculator Find The Best Car Price

Virginia Sales Tax Calculator Reverse Sales Dremployee

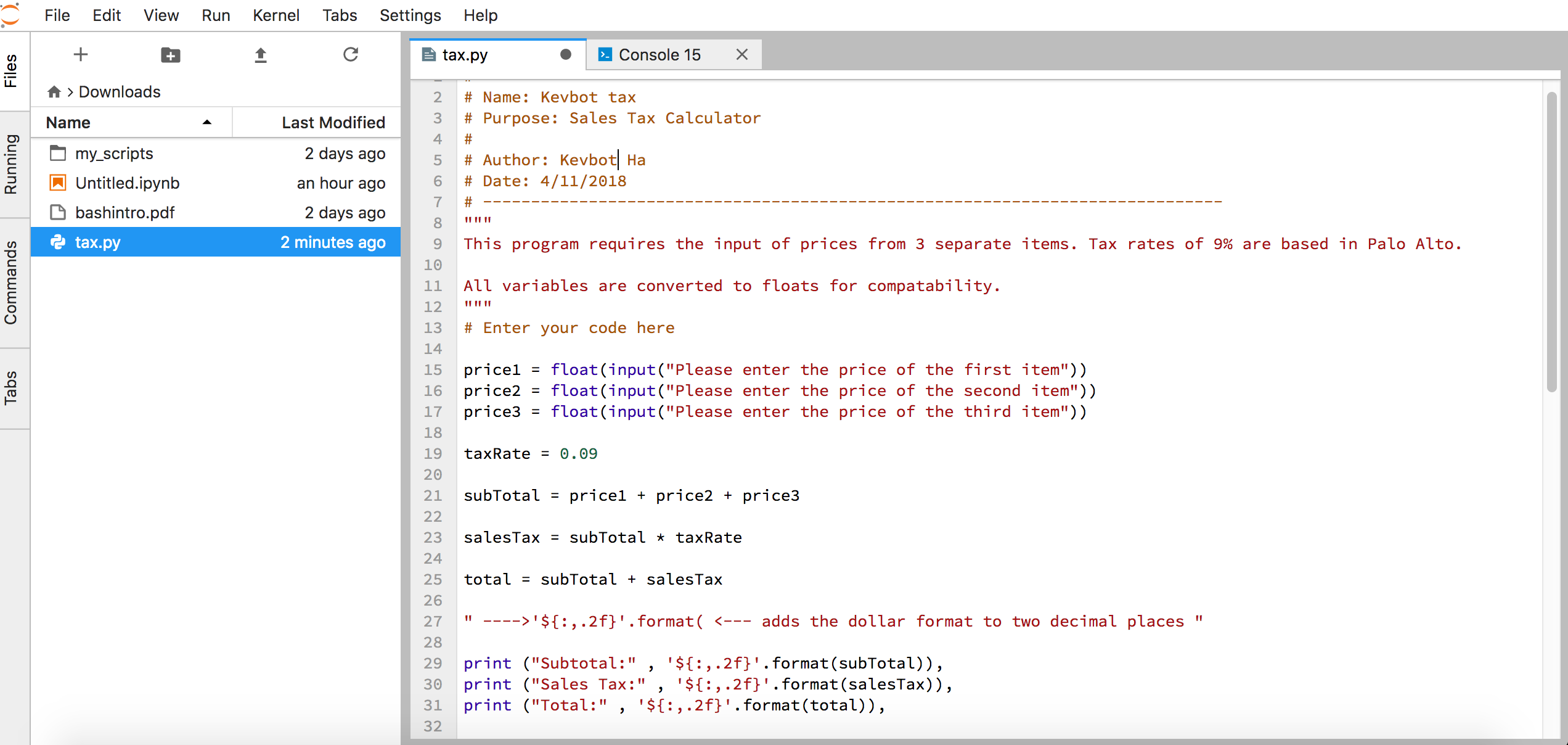

Car Tax By State Usa Manual Car Sales Tax Calculator

Capital Gains Tax Calculator 2022 Casaplorer

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Calculateme Com Calculate Just About Everything Area Of A Circle Gas Mileage Calculator

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

Car Tax By State Usa Manual Car Sales Tax Calculator

Tax Calculator For Items Clearance 54 Off Www Ingeniovirtual Com